We've Found the Perfect Balance

We’re not too big, but we equip you with the tools and support you need to hold your own with anyone in the industry.

We’re not too small either—just small enough to keep our structure flat and red tape out of your way.

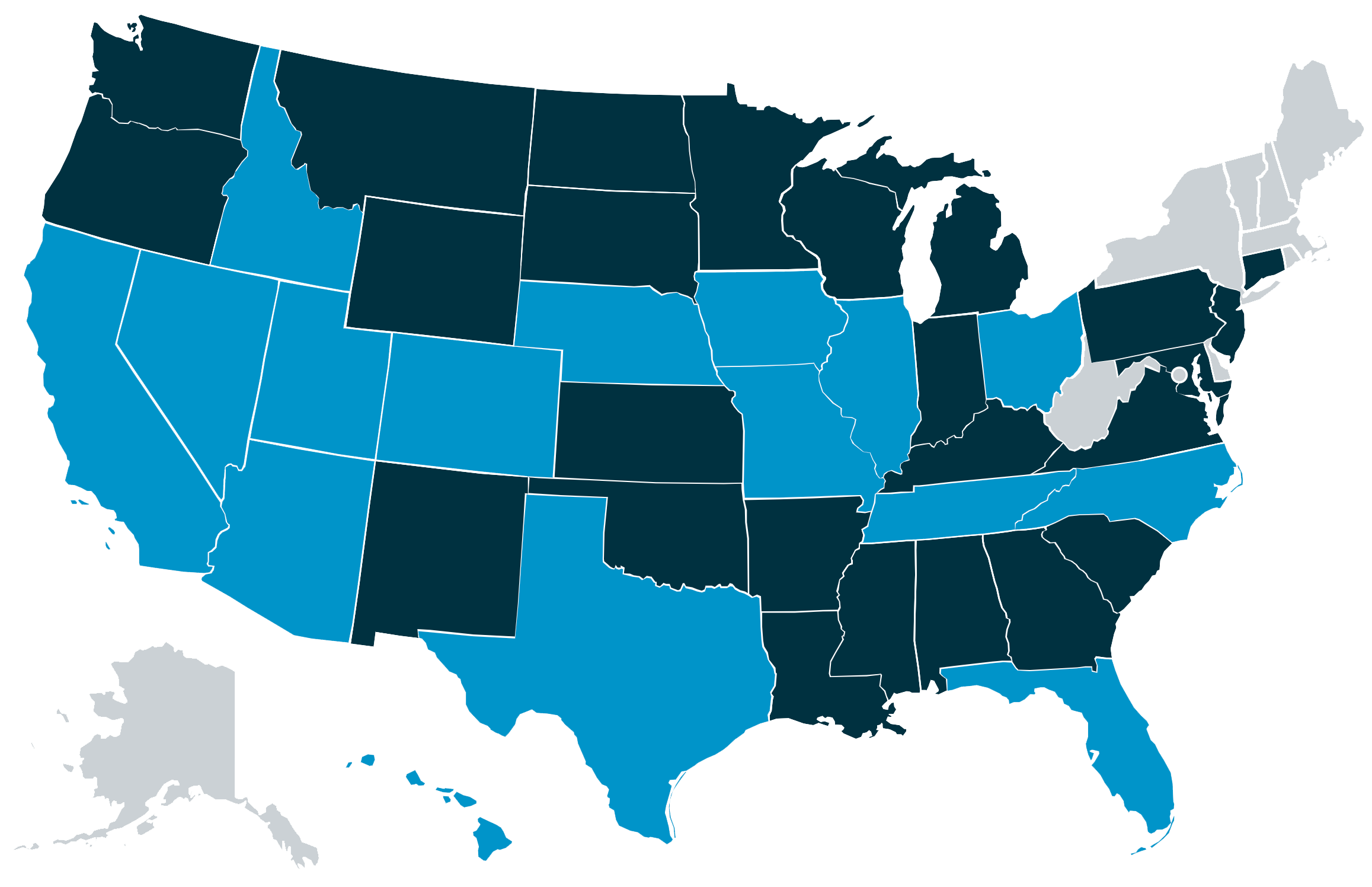

Licensed in 41 States

We offer opportunities all over the country.

There’s plenty of business out there, but saturating our markets with branches and Loan Officers isn’t something we do.

Rivalries should be reserved for the competition, not your teammates.

Relationships Are at the Center of What We Do

We’ve helped a lot of families realize the dream of homeownership, but we’re not even close to done: there are more people to help, more story to write, and so many more dreams to fulfill.

We put the customer experience right where it belongs: at the center of everything we do.

Our Mission:

Creating sustainable financial foundations through the benefits of homeownership.

Our Vision:

Fulfilling dreams and building successful tomorrows through refreshingly uncomplicated home loan experiences.

The Key to Your Castle®

Whether they’re looking for their first home, want to refinance, find an investment property, build a home, or simply need to get pre-qualified for a home loan, Castle & Cooke Mortgage is ready to serve our borrowers.

We employ high caliber talent, including in-house processors and underwriters, so they can rely on us for dependable service that’s attuned to their goals.

A Full Suite of Home Loan Products:

- Conventional Home Loans

- Federally Backed Loan Programs

- HomeReady and Home Possible Loans

- Home Loan Refinance

- Investor Loans

- Brokered Home Loans

- State-Specific and Other Assistance Programs

- Non-QM Loans

Best in Class Operations

Over 40% of our files are processed as One-Touch. What’s a One-Touch you ask? A file that makes it through Underwriting the first time, clear-to-close, without any conditions.

This translates into faster turn times and fewer conditions, making us twice as efficient as other mortgage companies.

Business Development

Our business development and sales coaching program is a powerful approach that helps loan officers Captivate, Cultivate, and Connect with leads, past clients, and real estate agents.

Captivate:

Use powerful web, mobile, and social marketing tools to attract future clients and real estate agents.

Cultivate:

Become the go-to expert and win client and trust with personalized email campaigns and engaging, informative content.

Connect:

Maintain the relationships you work so hard to build and provide value long after closing.

Marketing

Guided by Millennial Insight and Gen Z Enthusiasm, we rock an in house team of marketing experts dedicated to four core goals: increase market share, increase LO production, increase LO recruitment and retention, and help establish and nurture relationships between agents, builders, and you.

Whether you’re looking for print assets, swag, cobranded collateral, social media, email campaigns, digital marketing, or event support, our expert team has you covered.

Cutting-Edge Technology

Thanks to partnerships with industry-leading mortgage technology companies, we offer a powerful tech-stack: a mobile app, a next-gen automated marketing platform, credit monitoring alerts, and a powerhouse home equity reporting tool.

Our featured technology partners:

- Homebot

- Total Expert

- nCino (formerly known as SimpleNexus)

A Culture of Recognition

We only employ loan officers who love what they do, and it shows! That kind of dedication and outstanding performance deserves to be celebrated and rewarded.

The Summit Club recognizes our highest achieving producers, branches, and processors and rewards them with an unforgettable trip to a fabulous destination.

The Summit Club is more than just a vacation, though. It’s an important part of our company culture—bringing a sense of fun, adventure, and competition while inspiring us all to reach our highest peak.

Award-Winning Workplace

Castle & Cooke Mortgage has received multiple awards in recent years for being a workplace of choice. Recent recognitions include being named to distinguished lists such as Scotsman Guide's Top Workplaces, Fortune’s Top 100 Best Medium Workplaces, Mortgage Executive Magazine’s Top 100 Best Companies to Work For and National Mortgage Professional’s Top Mortgage Employers.

Castle & Cooke Mortgage, LLC is an Equal Opportunity Employer

What We Do for Our Employees

Competitive Compensation

Excellent medical & dental insurance

401(k) with company match

Health & wellness benefits and activities

Regular employee appreciation events

Annual Summit Club awards trip

Management is very supportive, soliciting input & willing to listen

Management is very supportive, soliciting input & willing to listen to field staff, frequently resulting in new products and support as needs are identified, altering processes to make it easier, implementing new support systems, marketing, etc.

The team and the amount of support that is available is helpful in getting started

Being a loan officer is a tough position especially when starting off new. The team and the amount of support that is available is helpful in getting started. Lots of resources to never feel lost.

Co workers work very well together. Our 24 hour average underwriting turn times are amazing

Open door policy with management that is easy to talk to. Learning is hands on and if you are engaged and eager to learn, you will love it. Managers are very willing to assist with training and jumping in to assist where needed. Co workers work very well together. Our 24 hour average underwriting turn times are amazing with loans that often are clear to close with the first underwrite.

This company is doing everything it can to keep progressing in this current market down turn.

This company is doing everything it can to keep progressing in this current market down turn. We had some major downsizing recently, as have all mortgage companies. To say it stung is an understatement. We lost some amazing team members, hard decisions had to be made to keep our doors open as long as possible. We will get through this!

We are a team. We all work hard towards a common goal.

The relationships you will build here are lasting. You are welcomed and can ask any questions. We are a team. We all work hard towards a common goal. They are very open to feedback. When I suggest something to managers they take it seriously.

If YOU have the desire to grow, CCM will back you 100%. Work hard, play hard!

Management sees in you what you may not & cheers you on to be the best that you can be. If YOU have the desire to grow, CCM will back you 100%. Work hard, play hard!

Not too big - not too small. Direct access to management.

Medium Sized mortgage banker platform - Not too big - not too small. Direct access to management. Amazingly fast underwriting turn times and common sense underwriting with a customer service mindset.

I am successful at my job because of the training provided and all the communication that occurs within the company.

As someone who joined the company with zero experience in the mortgage industry and coming from 26 years of the educational field, I have had the most amazing experience with this company and those I work with and have worked with. I have never felt untrained or unheard; I believe that I am successful at my job because of the training provided and all the communication that occurs within the company.

Copyright 2025 Castle & Cooke Mortgage, LLC | NMLS#1251 | Equal Housing Lender | All Rights Reserved