What is FICO, anyway?

FICO is a special kind of credit score created by the Fair Isaac Credit Corporation. It’s been around for about three decades, and lenders use it about 90% of the time when they’re deciding whether to lend money.

Every individual can get a FICO score from each bureau—TransUnion, Experian and Equifax. Mortgage lenders usually order scores from all three bureaus in case there are any big differences.

Your final FICO number isn’t the same as what you’ll get when you check your own credit report using tools such as annualcreditreport.com. Instead, it relies on a complicated mathematical formula known as an algorithm.

What’s not in your FICO score

FICO was designed to be as fair as possible, so it only looks at things that can be found on your credit report. And even if the following are on your credit report, they aren’t part of your FICO score:

- Race

- Color

- Religion

- National origin

- Sex

- Marital status

- Where you live

- Interest rates on other credit accounts

- Child support obligations

Mix of factors

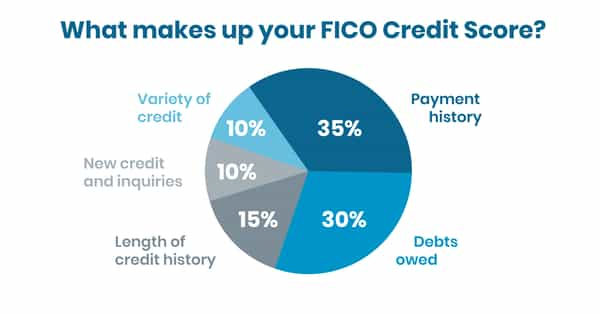

Each FICO score is unique, but looks at similar things. Think of yours as a mashup of five components.

Payment history: 35%

While many demographic and personal details aren’t part of your score, your past actions are very important. How often you've made payments on time is the biggest factor. The more often you’ve paid on time in the past, the reasoning goes, the more likely you are to pay new debts (like a house payment) on time.

Debts owed: 30%

The next thing lenders want to know is how much debt you already owe. In addition to looking at whether you owe money, this part of the algorithm looks at credit utilization, meaning how much of your available credit you’re using.

If you had a credit card with a high limit but paid it off every month, for example, that would mean low credit utilization and a higher credit score. But if you had a low balance card that’s at the limit and you were just making minimum payments, your credit utilization would be high and your score might suffer.

Length of credit history: 15%

Next, lenders want to know how long you have had credit. In other words, they want to know how long you have been borrowing money. This factor considers your oldest account, your newest account, and the average age of all accounts.

New credit and inquiries: 10%

If you have a lot of new accounts, or if you’ve been trying to open new accounts, lenders assume you are a higher risk. This is especially true if you don’t have a long credit history.

It’s OK to check your own score for free once a year, and some other exceptions may apply, but it’s a good rule of thumb not to open too many new accounts at once.

Variety of credit: 10%

The last thing lenders want to know is your credit mix. This factor checks that you have a good balance of credit types and considers how many of each of the following you have:

- Credit cards

- Student loans

- Installment loans

- Retail accounts

- Auto loans

- Mortgages

- Other debt

Maximizing your home loan opportunities

As you can see, the subject of credit and financial trustworthiness is pretty complicated. And we haven’t really even scratched the surface! There are multiple kinds of FICO scores in addition to other kinds of credit scores, and they all change pretty quickly.

It’s important to keep these factors in mind in your everyday financial decisions, but only a licensed credit counselor is qualified to give you specific advice on how to earn the highest scores.

Loan Officers at Castle & Cooke Mortgage are not credit counselors, but they have a lot of experience and can answer many of your credit-related questions.

If you’re ready to see if you can pre-qualify for a mortgage, we would love to chat.