Interest rates and home loans go hand in hand, and having the right information can help you get into the best possible financing for your situation.

Once you know how mortgage rates work on a broad economic level, it makes sense to wonder what interest rate you and your family could get on your next home loan.

The simple answer is, lenders base rates and terms on four major criteria, referred to by the acronym IPAC:

- Income: How much you bring in each month

- Property: The home you’re hoping to buy

- Assets: Your savings and investments

- Credit: Your financial history and debts owed

But IPAC is just a starting place. To understand more about how rates are determined (and learn how to improve yours), you'll need some background info.

Two kinds of mortgage rates

First, let’s look at the two kinds of rates and what they mean.

The interest rate is the amount you pay your lender for the privilege of borrowing money every year, expressed as a percentage of the total loan amount. At their lowest point during the pandemic, interest rates for home loans hovered around 2.65%, but that was an anomaly. Historically, rates have been closer to 8%.

The next kind of rate to understand is APR, short for annual percentage rate. This figure is almost always higher than the rate alone because it accounts for all the costs of the loan, including origination fees and discount points.

Toward the beginning of the loan process, you will receive a Loan Estimate that includes both interest rate and APR. If you're comparing different loan programs (or even different lenders), you'll see interest rate and APR listed for every option.

Why mortgage rates matter

Small differences in rates may not seem like a big deal, but a rate that’s lower by just a few basis points (the numbers after the period) can save you both in monthly payments and in total interest paid over the life of the loan.

If you put 20% down on a $500,000 home, your total loan would be $400,000. With a 30-year loan and an interest rate of 6.25%, your monthly payment (including taxes and insurance) would be $3,400.37. If your rate were 6%, your monthly payment would drop to $3,335.70.

That monthly payment difference isn’t huge—just $64. But what about total interest paid over the life of the loan?

With a 6.25% rate on that $400,000 loan, you would pay $486,634 in interest by the end of your 30-year term. If your rate were 6%, however, you would pay just $461,113 in interest in that same timeframe. The difference is a whopping $25,521!

How to lower your mortgage rate

1. Improve your credit score

Your credit history is one of the most important ways lenders determine how likely you are to repay your loan on time. They use a special kind of credit score called FICO to determine rates.

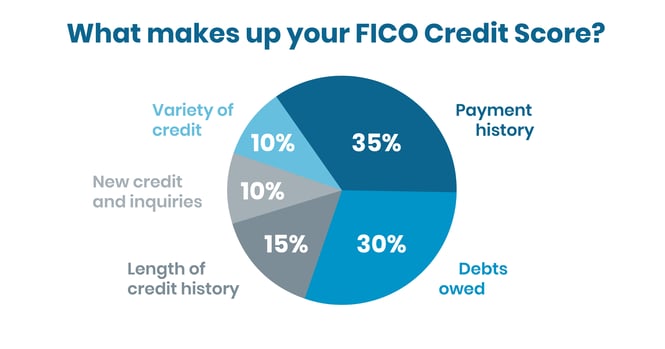

Each person’s score is made up of five factors: payment history, debts owed, variety of credit, new credit inquiries, and length of credit history.

To qualify for a home loan with Castle & Cooke Mortgage, you’ll need a credit score of at least 600 (even for government-backed loans). For the best rates and terms, you’ll need a score of 740 or higher.

You can improve your score by:

- Fixing errors on your credit reports

- Paying down debts

- Paying your bills on time

- Using credit wisely

2. Grow your savings (assets)

Having a bigger down payment is another important way to improve your interest rate. If you’re an investor, you may need to put down as much as 30% for the best possible rate. As a first-time homeowner, you may be able to get a home loan with as little as zero down. A down payment of 25% or more will get you the best rates.

A bigger savings account can help in other ways, too. You’ll need money for closing costs, which can total 3%-6% of your home’s total value. You’ll also need at least two months of financial reserves, meaning two months of PITI (payment, interest, taxes, and insurance), to get the best possible rates.

3. Increase your income

The more you make, and the more steady your income, the more likely you are to qualify for the best possible mortgage rates. While it may not be easy to get a bigger salary at your current job, you could grow your income by taking on a second job or adding income from a co-borrower. Talk to your loan officer early in the process for details.

4. Choose the right property

Single-family homes occupied by their owners generally get the best rates, but you’ll pay slightly higher rates for condos, second homes, and investment properties. The location of your property may also affect your rate.

Your real estate agent and loan officer will help you understand all the details.

5. Choose the right home loan

Most lenders offer dozens of loan programs, and each loan program calculates rates differently. It gets pretty complicated, and you should definitely ask your loan officer which program is best for your situation.

As you prepare for that conversation, here are a few basics to keep in mind:

- Conventional loans get higher rates than government-backed programs such as VA loans, FHA loans, and USDA loans (but don't forget about mortgage insurance)

- 15-year loans get better rates than 30-year loans

- Adjustable rate mortgages (ARMs) start at lower rates, but those rates can increase dramatically over time

- Fixed-rate loans may start out higher, but they stay at the original rate through the life of the loan

6. Consider buying down the rate by paying discount points upfront

The most direct way to get a better interest rate is to buy discount points. Here’s how it works:

Each point is worth 1% of your total loan amount. In the example listed above, buying a single point on a $400,000 loan would cost $4,000. Depending on market conditions, you may be able to reduce your rate by 0.25% (or more) by paying 1% of your loan upfront.

By the end of your term, that reduction would be worth the $20,915 we mentioned in the first example. Better yet, discount points are tax deductible!

Sounds tempting, right? But keep in mind that you will only start seeing a return on buying points after making payments for several years. Let your loan officer know how long you’re planning to stay in your new home, and they'll be happy to crunch the numbers.

7. Be willing to refinance

Rates are still hovering near historic lows, but no one knows how long they’ll stay this low. No matter what rate you qualify for when you first buy a home, it's common to refinance a few times before you buy your next home.

Being willing to refinance when it makes sense can have big benefits, including:

- Lowering your interest rate

- Shortening your term

- Tapping your equity to reinvest in the home

- Taking out cash to pursue your dreams

Every time you refinance, you'll qualify for a new rate. That doesn't mean you need to watch daily rate changes, but you should keep in contact with your loan officer even after your mortgage is completed. That way, you can take advantage of refinance opportunities as you pay down your principal, gain more equity, and continue improving your credit.